Get in touch

with us today…

Contact us for a private viewing to see a granny flat in your area today!

Employment Opportunities

We are always open to hiring motivated and creative workers who share our same passion to provide high-quality dwellings and attentive customer service.

If you are interested, please submit your details and resume.

The Investor’s Guide to Renting Out a Granny Flat in NSW

Investing in a Granny Flat can be a smart move for property owners in New South Wales. Whether you’re looking to earn some extra income from the rent or provide affordable housing options, a Granny Flat can be a lucrative and worthwhile investment.

However, renting out a Granny Flat requires careful planning and attention to legal and practical considerations. In this guide, we’ll cover everything you need to know about renting out a Granny Flat in NSW, including legal requirements, potential rental income, and tips for managing your property.

Advantages of Renting Out a Granny Flat in NSW

There’s no doubt that Granny Flat rentals, also known as secondary dwellings, have gained popularity in recent years. Their potential to generate additional income and provide flexible living arrangements have given property owners an affordable option when it comes to optimising their property’s total value. In NSW, renting out a Granny Flat can offer numerous advantages for homeowners.

Let’s explore some of the key benefits of renting out Granny Flats from a financial and lifestyle perspective.

- Gain an income from your property: Expect a rental return of anywhere between $300–$700 per week. The taxable income can help offset your home loan payments or even contribute to your retirement savings.

- Tax deductions: Depending on your circumstances, you may be able to claim tax deductions related to the construction, maintenance and management of the Granny Flat. Consulting a qualified tax professional is advisable as they understand the specific tax implications, such as capital gains tax, and benefits.

- Flexible living arrangements: The extra living space offers flexible living options for both homeowners and tenants. The Granny Flat can accommodate family members while maintaining privacy from the main residence. Tenants, on the other hand, can enjoy the secondary dwelling as an affordable housing option in a desirable location.

- Increased property value: A secondary dwelling is viewed as a property investment and can increase the value of your entire property. The potential for extra income makes a Granny Flat an attractive feature for buyers. It also increases the value of the property when it comes to selling as a Granny Flat maximises the capital gain.

- Affordable housing solution: Given the recent rental market trends, renting out a Granny Flat can help address the affordable housing shortage in Australia. Renting out a Granny Flat provides an alternative to traditional rental properties and share houses.

Granny Flat ROI Calculator

New South Wales’ Legal Considerations

Building a Granny Flat and navigating the legal considerations can seem like a minefield, but it doesn’t have to be. Get professional advice from experts in the industry who have experience with your local council and who can help determine how and if you can build a Granny Flat on your property.

It is imperative that your Granny Flat adheres to all relevant local legislation as well as state building regulations. Local council regulations will stipulate specific Granny Flat rules and restrictions related to the Granny Flat size, setback requirements and parking provisions, among other factors.

Let’s dig a little deeper and see what other legalities you must consider before building a Granny Flat…

Permits and Approvals Needed to Construct a Granny Flat

As a general rule, property owners don’t need council approval to build a Granny Flat as long as it adheres to the minimum requirements set out by the NSW government.

- The property must be 450m2 or larger.

- A secondary dwelling must only be built in an area zoned residential.

- Ensure there is a maximum of 60m2 of internal space.

- There should be a 12-metre width at the building line of your main dwelling; otherwise, you can build an attached Granny Flat.

- Only one Granny Flat can be built per single lot.

- Granny Flats cannot exceed a height of 8.5 metres.

- There must be a setback of 3 metres from the back of the house and at least 0.9 metres from the boundaries at the sides.

- Maintain a distance of 3 metres from any existing trees with heights of 6 metres or more.

Once your Granny Flat meets all the criteria, a private certifier will approve the build of the Granny Flat. They will issue a Complying Development Certificate (CDC), and you can start the construction. During the construction, you will need to obtain the necessary plumbing and electrical approvals to ensure the work meets regulatory and building standards.

At the cessation of your project, the private certifier will inspect and authorise the occupation of the Granny Flat. If all site works are completed safely and to the building code, you will be issued an Occupation Certificate (OC).

If your proposed Granny Flat doesn’t meet the minimum requirements, all is not lost. You can go through the process of obtaining Development Approval (DA) from your local council. Consult your local council and speak with your Granny Flat builder to understand the application process.

Zoning and Planning Requirements for Granny Flats

It’s worthwhile noting that there are many ‘do’s and don’ts’ associated with renting out a Granny Flat. Some of these relate to the zoning and planning obligations that can restrict your project from the outset. Let’s delve deeper.

- R2 Low-Density Residential Zone: Granny Flats are typically permitted in residential areas zoned as R2. However, check with your local council to confirm zoning requirements and any additional restrictions that may apply.

- Site Suitability and CDC Requirements: Evaluate your property’s size, setbacks, and access to utilities to determine if it is suitable for building a Granny Flat.

- Overlooking and Privacy: Consider the privacy of both the main house and the Granny Flat when designing the layout, ensuring adequate separation and privacy for all occupants.

Insurance Considerations for Landlords

Think of your Granny Flat rental as an investment property. Accordingly, it should be protected as one. Save money in the long run and consider getting landlord insurance as well as building and contents insurance:

- Landlord Insurance: Protect your Granny Flat by obtaining a comprehensive landlord insurance policy. This type of insurance typically covers risks such as tenant damage, loss of rent and public liability.

- Building and Contents Insurance: Ensure your Granny Flat is adequately insured for its structure and contents, including fixtures, fittings and any appliances provided to tenants.

Potential Rental Income

The main reason why Granny Flat rentals have grown in the property market in Australia is the extra cash that the rent provides. Even though potential rent from a secondary dwelling ranges from $300 to $700, it can be higher or lower depending on several factors.

It is important to conduct thorough research and consult your local real estate agent or property managers with up-to-date knowledge of rental market conditions in your area of interest.

By taking time to speak to the right consultants and doing the groundwork, you can reap the benefits of the added income your Granny Flat can provide. Anyone can rent out a Granny Flat if they do their due diligence first!

Factors that Impact the Rental Income You Can Earn From a Granny Flat

Location

Properties in high-demand areas or areas close to amenities, such as schools, public transportation, and shopping centres, tend to command higher rent prices.

Size and condition

A Granny Flat that is larger and well-maintained will generally attract a tenant that will pay a higher rent.

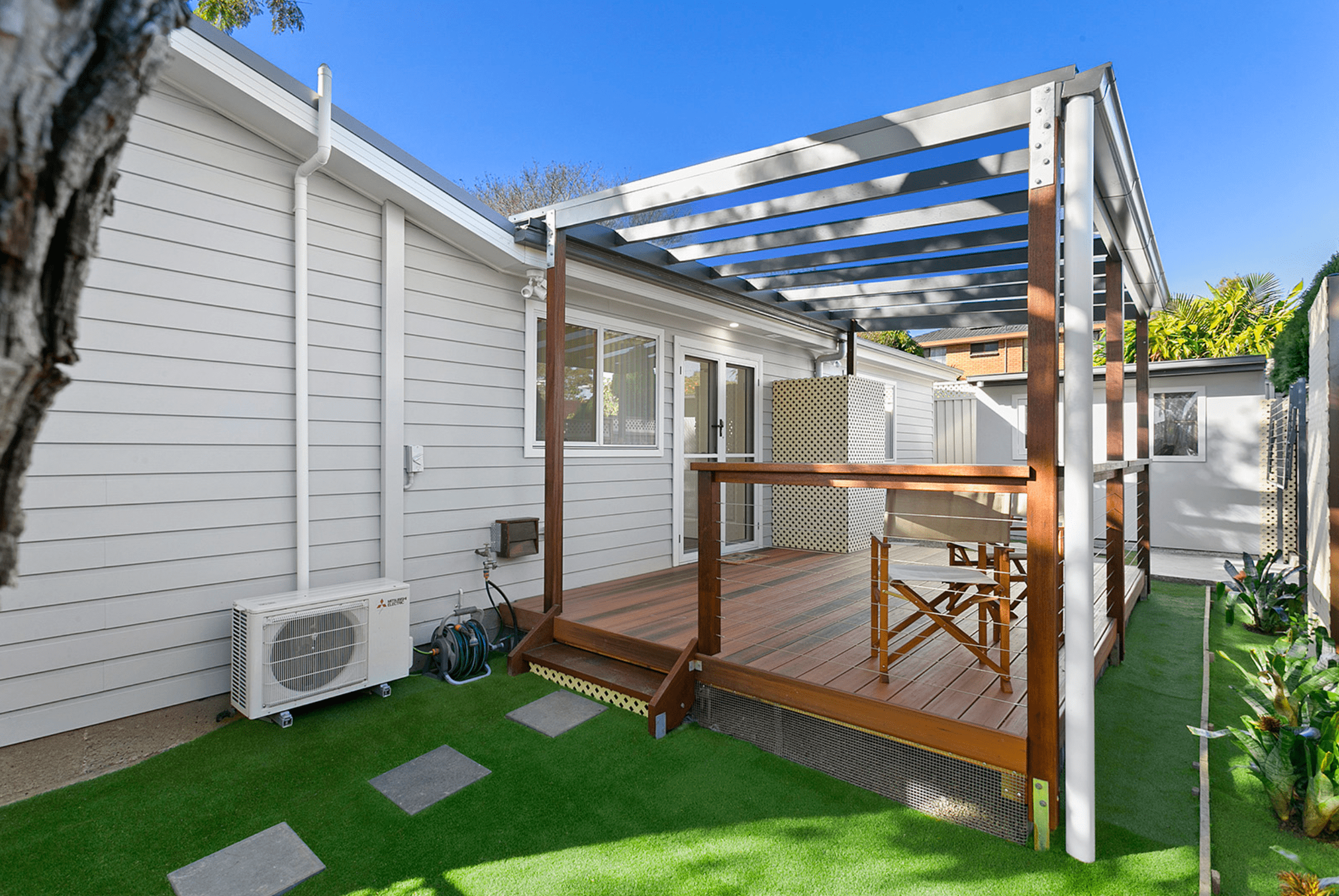

Design and features

Attractive designs and features, such as modern kitchens, upscale bathrooms, air conditioning, private entrances and dedicated parking spaces, are more desirable.

Market demand

Local market demand for rental properties, including Granny Flats, can impact rental income. Areas with high demand and low supply may have higher rental prices.

Economy

Broader economic conditions, such as interest rates, employment rates and overall market trends, can influence rent prices as well as tenant demand.

Examples of Typical Rental Income for Granny Flats in Different Parts of NSW

- Sydney: $350–$700

- Newcastle: $250–$500

- Gosford: $250–$450

- Western Sydney: $250–$550

- South-West Sydney: $220–$450

Tips for Maximising Rental Income

- Research the rental market to understand local rental demand, average rental rates and tenant preferences.

- Enhance curb appeal and interior to make the building more aesthetically pleasing.

- Evaluate the cost–benefit analysis of furnishing the Granny Flat.

- Utilise various marketing channels, such as online real estate platforms, social media platforms, and local advertising, to promote your Granny Flat.

- Maximise tax benefit insights into deductible expenses, depreciation claims and any available tax incentives specific to Granny Flats.

- Understand capital gains tax (CGT) and other tax obligations while considering the impact on your Granny Flat investment.

- Claim tax deductions on expenses such as council rates, depreciation, repairs and advertising costs, to name a few.

Property Management

Managing a Granny Flat rental property efficiently requires effective property management practices and thorough tenant screening. Fair Trading NSW also offers a great resource for landlords on how to manage their secondary dwellings effectively.

Here are a few tips to help you successfully manage your property investment.

Best Practices for Managing a Granny Flat Rental Property

Developing a detailed lease agreement that covers all important aspects of the tenancy will go a long way in protecting your interests and managing your Granny Flat. This includes the amount of rent, due dates, deposit details, maintenance responsibilities and Granny Flat rental rules. By clearly outlining tenant obligations and landlord rights, you can avoid any potential conflicts or misunderstandings.

Tips for Finding and Screening Tenants

- Advertise using online platforms, such as real estate websites and social media, or engage a local real estate agent.

- Create compelling rental listings with attractive photos, detailed property descriptions and clear information about the Granny Flat’s features, location and rental terms.

- Request completed rental application forms from prospective tenants to gather information on employment history, income, references and previous rental experiences.

- Ask pre-screening questions to assess potential tenants’ suitability, such as their preferred move-in date, desired lease term, income level and any specific requirements.

- Confirm the applicant’s identity by requesting copies of identification documents, such as a driver’s license or passport.

- Meet prospective tenants for a face-to-face interview.

Maintenance and Repair Considerations for Landlords

Renting out a Granny Flat requires regular property inspections to assess its condition and identify any maintenance or repair needs. It is always wise to address issues promptly to ensure tenant satisfaction and property preservation.

Communicate with tenants about upcoming inspections, providing sufficient notice as required by local laws.

Strategies for Handling Tenant Disputes and Issues

There is nothing better than opening the lines of communication with tenants and promptly responding to their enquiries and repair requests.

Establish a reliable method of communication, such as email or a dedicated property management platform to ensure efficient and documented correspondence.

Where communication fails, NSW Fair Trading can help mediate and act as a negotiator.

In Summary | Renting out a Granny Flat in NSW

Renting out a Granny Flat in NSW can be a rewarding investment, but it’s important to approach it with the right mindset and knowledge.

By understanding the legal requirements, potential rental income and best practices for managing your property, you can make the most of your Granny Flat investment and create a successful rental property.

The team at Granny Flat Solutions are the premier Granny Flat builders in NSW. Get in touch to see how we can help you benefit from renting out a Granny Flat and earn a passive income.

Ready to start your building journey? Chat to our team of experts today and get a FREE personalised quote

Find Out More

“Experience the difference for yourself.”

Call 02 9481 7443 or contact us online now to book your free site inspection and quote.